Renters Insurance in and around Chattanooga

Get renters insurance in Chattanooga

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

- Hamilton County

- Chattanooga

- East Brainerd

- Bradley County

- Catoosa County

- Walker County

- Whitfield County

- Sequatchie County

- Hamilton Place

- Brainerd

- East Ridge

- Red Bank

- Cleveland

- Harrison

- Ooltewah

- Apison

- Collegedale

- Ringgold

- Graysville

- Rossville

- Fort Oglethorpe

- Cohutta

- Westview

- Signal Mountain

Home Is Where Your Heart Is

Your rented space is home. Since that is where you make memories and spend time with your loved ones, it can be a good idea to make sure you have renters insurance, even if your landlord doesn’t require it. Even for stuff like your running shoes, hiking shoes, desk, etc., choosing the right coverage can insure your precious valuables.

Get renters insurance in Chattanooga

Rent wisely with insurance from State Farm

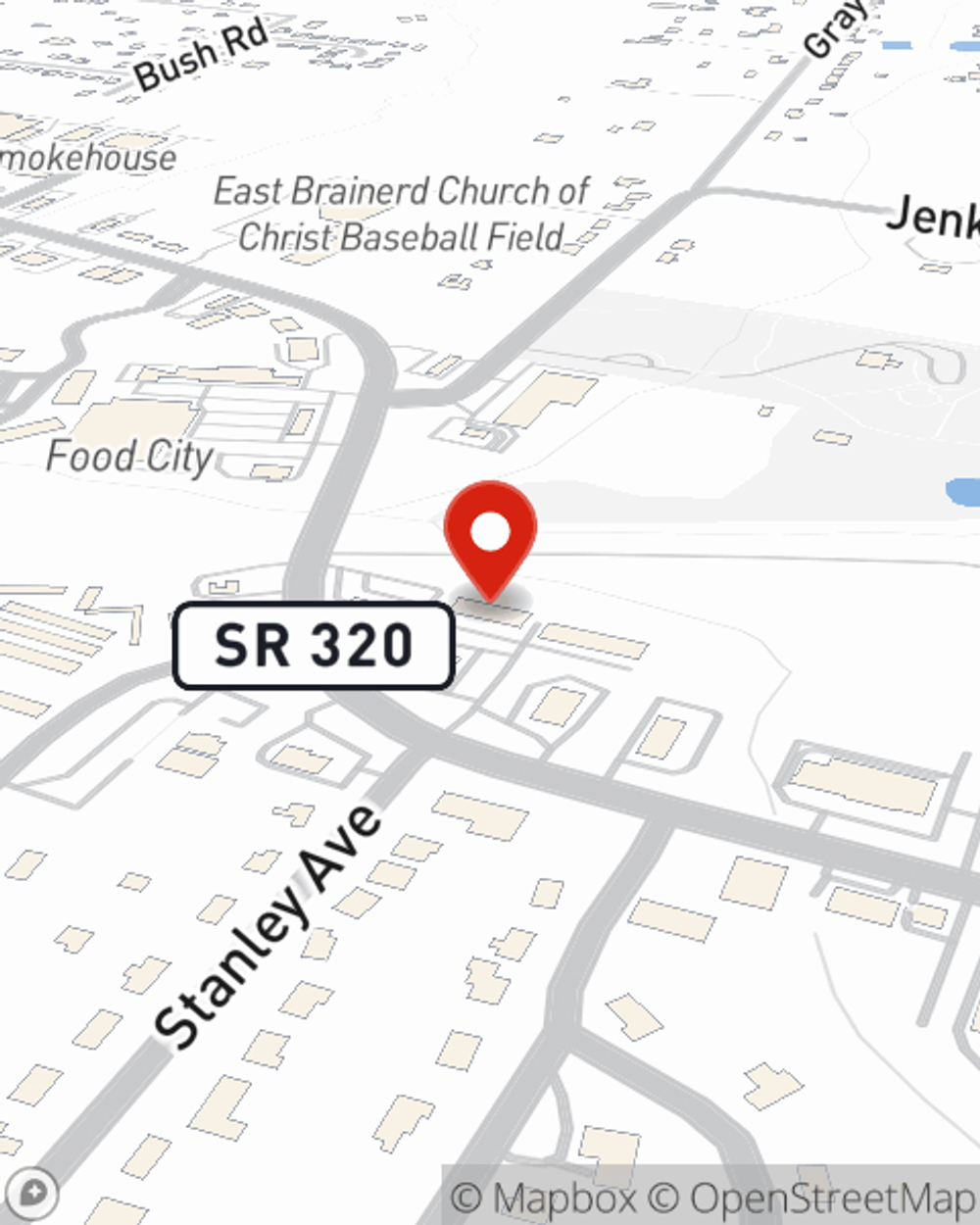

Agent Jon Lakamp, At Your Service

It's likely that your landlord's insurance only covers the structure of the apartment or townhome you're renting. So, if you want to protect your valuables - such as a TV, a dining room set or a bicycle - renters insurance is what you're looking for. State Farm agent Jon Lakamp wants to help you understand your coverage options and protect yourself from the unexpected.

Reach out to Jon Lakamp's office to discover the advantages of State Farm's renters insurance to help keep your valuables protected.

Have More Questions About Renters Insurance?

Call Jon at (423) 894-5568 or visit our FAQ page.

Simple Insights®

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.

Simple Insights®

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.